Kampala: Uganda’s capital markets are increasingly reflecting the concentration of wealth in a handful of blue-chip counters, with banking and telecommunications stocks driving the fortunes of the country’s most prominent individual investors.

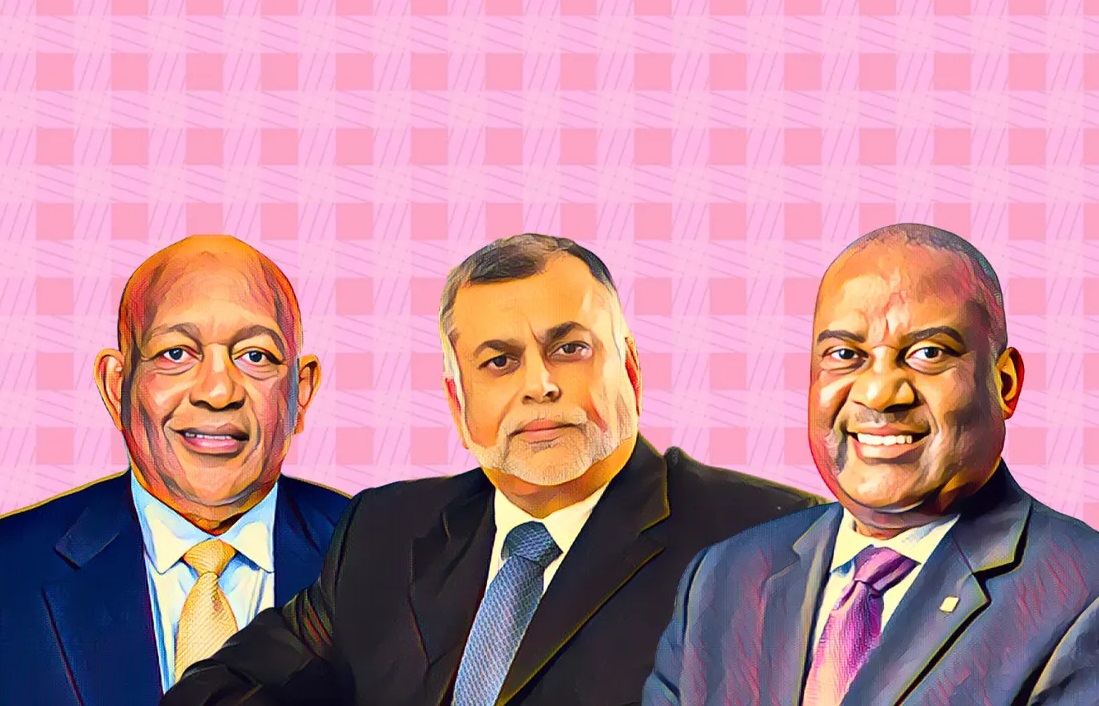

Latest analysis of disclosed shareholdings on the Uganda Securities Exchange (USE) shows that tycoons Charles Mbire and Sudhir Ruparelia are the richest individual investors on the bourse, underscoring the dominance of a few large listings in shaping market wealth.

Mr Mbire leads the rankings with an estimated portfolio valued at $91.1 million, while Mr Ruparelia follows with holdings worth approximately $11.4 million. The estimates are based on declared shareholdings priced using the latest closing figures on the USE, with currency conversion at Shs3,561.77 to the US dollar.

The snapshot comes at a time when the USE All Share Index has risen by 34 percent over the past 12 months, signalling renewed investor confidence despite ongoing global market volatility and tightening financial conditions in major economies.

Mbire’s MTN stake anchors lead

Mr Mbire’s commanding position is largely attributed to his 4 percent stake in MTN Uganda, one of the exchange’s most capitalised and actively traded counters. As board chairman of the telecommunications giant, he sits at the helm of a company that has consistently delivered strong earnings and dividend payouts.

Market analysts say MTN Uganda’s solid dividend history and substantial market capitalisation have significantly elevated Mr Mbire’s portfolio valuation compared to other individual investors.

Ruparelia’s banking investments

Mr Ruparelia ranks second, with his listed investments concentrated in the banking sector. He holds a 0.65 percent stake in Stanbic Uganda Holdings and a 2.5 percent stake in Bank of Baroda Uganda.

Although Mr Ruparelia’s overall wealth spans real estate, hospitality, education, insurance and manufacturing under the Ruparelia Group, his position on the USE ranking reflects only his interests in publicly traded companies.

Banking stocks dominate

The broader top 10 list reveals a strong concentration in financial services counters. Seven of the wealthiest individual investors derive the bulk of their portfolio value from banking stocks, particularly Stanbic Uganda Holdings and Bank of Baroda Uganda.

Top 10 richest Ugandan investors on the USE

| Rank | Investor | Estimated Portfolio Value | Key Holdings |

|---|---|---|---|

| 1 | Charles Mbire | $91.1m | MTN Uganda (4%) |

| 2 | Sudhir Ruparelia | $11.4m | Stanbic Uganda, Bank of Baroda |

| 3 | I.K. Kabanda | $4.0m | Stanbic Uganda |

| 4 | Ceasor Mulenga | $3.8m | Bank of Baroda |

| 5 | Frederick Kitaka | $3.4m | Quality Chemical Industries |

| 6 | Emmanuel Katongole | $3.4m | Quality Chemical Industries |

| 7 | George Baguma | $3.4m | Quality Chemical Industries |

| 8 | Michael Mbire | $1.9m | Bank of Baroda |

| 9 | Joseph Byamugisha | $1.3m | Bank of Baroda |

| 10 | Andrew Muhimbise | $1.2m | Bank of Baroda |

Pharmaceuticals make a notable entry

The appearance of Quality Chemical Industries investors Frederick Kitaka, Emmanuel Katongole and George Baguma signals a slow but important expansion beyond banking and telecoms into pharmaceuticals—one of Uganda’s emerging industrial success stories.

Market outlook

With the USE’s total market capitalisation now estimated at UGX 37.3 trillion, analysts say the exchange’s next growth phase will depend on attracting new listings in underrepresented sectors such as agribusiness, energy, technology and logistics.

For now, Uganda’s stock market wealth remains firmly in the hands of a small circle of well-positioned investors, many with long-standing corporate and family networks.